------------------------------------------ 2009 ----------------------------------------

to_poly: 2009, D:/web/blg/primeur/private/prices2009-all-scores.csv, note,

USE: s:/primeur2009-poly-4-log.csv, note

Global results

| Dependant variable | prix 2009 € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 372 |

| R2 | 0.76263433336362 |

| Adjusted R2 | 0.76199280453487 |

| Sigma error | 0.45401984498217 |

| F-Test(1,370) | 1188.7764028519(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 245.0473 |

dfR = 1 |

MSR = 245.0473 |

MSR/MSE = 1188.78 |

p < .0000* |

| Error |

SSE = 76.2696 |

dfE = 370 |

MSE = 0.2061 |

|

|

| Total |

SSTO = 321.3168 |

dfTO = 371 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=-4.080819 |

s{b0}=0.224700 |

t0=-18.161181 |

p < .0000* |

| note4 |

b1=0.000000 |

s{b1}=0.000000 |

t1=34.478637 |

p < .0000* |

* indicates significance

Stepwise selection process for prix 2009 €

| Step | 1 | 2 |

|---|

| R2 | 0.7626 | |

|---|

| note | 1150.16(0.0000) | 3.41(0.0655) |

|---|

| note2 | 1165.34(0.0000) | 3.43(0.0647) |

|---|

| note3 | 1178.29(0.0000) | 3.45(0.0640) |

|---|

| note4 | 1188.78(0.0000) | |

|---|

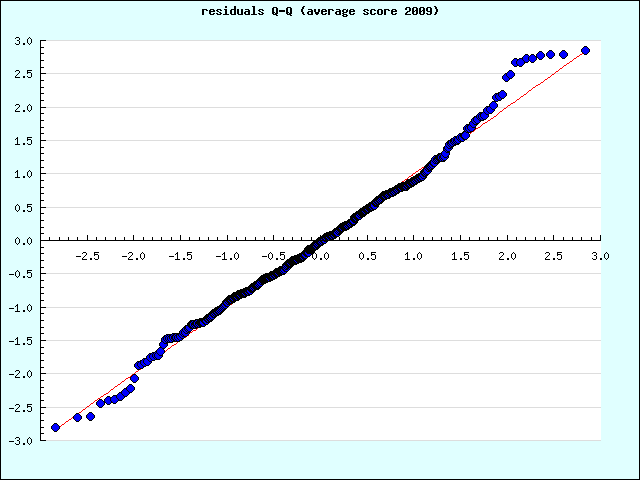

-------------- D'AGOSTINO ----------------

K2=54.749695565596 (5.2807620051876)2 + (5.1829767711387)2

(0)

d'Agostino: FAIL

------------------ ANDERSON-DARLING -----------------

A2=3.1009004874421

alpha=0

p-value=p < 0.01

A2=3.1009

(p < 0.01)

Anderson-Darling: FAIL

2009 OUT (1) : Haut-Brion blanc;Pessac-Léognan;94;796.56;2.0747044385806

Global results

| Dependant variable | prix € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 371 |

| R2 | 0.77209096167001 |

| Adjusted R2 | 0.77085232559213 |

| Sigma error | 0.43954103032889 |

| F-Test(2,368) | 623.33963579621(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 240.8538 |

dfR = 2 |

MSR = 120.4269 |

MSR/MSE = 623.34 |

p < .0000* |

| Error |

SSE = 71.0962 |

dfE = 368 |

MSE = 0.1932 |

|

|

| Total |

SSTO = 311.9501 |

dfTO = 370 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=5.330074 |

s{b0}=4.489650 |

t0=1.187191 |

p = 0.2359 |

| note4 |

b1=0.000000 |

s{b1}=0.000000 |

t1=2.683891 |

p = 0.0076* |

| note3 |

b2=-0.000047 |

s{b2}=0.000023 |

t2=-2.085480 |

p = 0.0377* |

* indicates significance

Stepwise selection process for prix €

| Step | 1 | 2 | 3 |

|---|

| R2 | 0.7694 | 0.7721 | |

|---|

| note | 1187.28(0.0000) | 4.27(0.0394) | 0.56(0.4564) |

|---|

| note2 | 1204.27(0.0000) | 4.31(0.0385) | 0.57(0.4516) |

|---|

| note3 | 1218.98(0.0000) | 4.35(0.0377) | |

|---|

| note4 | 1231.16(0.0000) | | |

|---|

-------------- D'AGOSTINO ----------------

K2=43.892753053427 (4.6725935834335)2 + (4.6967672134653)2

(0)

d'Agostino: FAIL

------------------ ANDERSON-DARLING -----------------

A2=2.8635166722759

alpha=0

p-value=p < 0.01

A2=2.863517

(p < 0.01)

Anderson-Darling: FAIL

2009 OUT (2) : La Mission Haut-Brion blanc;Pessac-Léognan;94;725.55;2.0284390201699

Global results

| Dependant variable | prix € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 370 |

| R2 | 0.77911893160049 |

| Adjusted R2 | 0.77791522005608 |

| Sigma error | 0.42710791073085 |

| F-Test(2,367) | 647.26381932425(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 236.1492 |

dfR = 2 |

MSR = 118.0746 |

MSR/MSE = 647.26 |

p < .0000* |

| Error |

SSE = 66.9486 |

dfE = 367 |

MSE = 0.1824 |

|

|

| Total |

SSTO = 303.0978 |

dfTO = 369 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=6.145444 |

s{b0}=4.366003 |

t0=1.407568 |

p = 0.1601 |

| note4 |

b1=0.000001 |

s{b1}=0.000000 |

t1=2.928847 |

p = 0.0036* |

| note3 |

b2=-0.000051 |

s{b2}=0.000022 |

t2=-2.318456 |

p = 0.0210* |

* indicates significance

Stepwise selection process for prix €

| Step | 1 | 2 | 3 |

|---|

| R2 | 0.7759 | 0.7791 | |

|---|

| note | 1224.44(0.0000) | 5.26(0.0224) | 1.12(0.2902) |

|---|

| note2 | 1243.39(0.0000) | 5.32(0.0217) | 1.14(0.2870) |

|---|

| note3 | 1260(0.0000) | 5.38(0.0210) | |

|---|

| note4 | 1274.01(0.0000) | | |

|---|

-------------- D'AGOSTINO ----------------

K2=25.251781403977 (3.4663352215129)2 + (3.6381728293301)2

(0)

d'Agostino: FAIL

------------------ ANDERSON-DARLING -----------------

A2=2.2834250593216

alpha=0

p-value=p < 0.01

A2=2.283425

(p < 0.01)

Anderson-Darling: FAIL

2009 OUT (3) : Raymond-Lafon;Sauternes;95;30.8;-1.5128620824199

Global results

| Dependant variable | prix € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 369 |

| R2 | 0.78672656241105 |

| Adjusted R2 | 0.78556113379035 |

| Sigma error | 0.42023859404512 |

| F-Test(2,366) | 675.0534081919(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 238.4295 |

dfR = 2 |

MSR = 119.2148 |

MSR/MSE = 675.05 |

p < .0000* |

| Error |

SSE = 64.6358 |

dfE = 366 |

MSE = 0.1766 |

|

|

| Total |

SSTO = 303.0653 |

dfTO = 368 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=5.967016 |

s{b0}=4.296066 |

t0=1.388949 |

p = 0.1657 |

| note4 |

b1=0.000001 |

s{b1}=0.000000 |

t1=2.954908 |

p = 0.0033* |

| note3 |

b2=-0.000051 |

s{b2}=0.000022 |

t2=-2.329116 |

p = 0.0204* |

* indicates significance

Stepwise selection process for prix €

| Step | 1 | 2 | 3 |

|---|

| R2 | 0.7836 | 0.7867 | |

|---|

| note | 1275.45(0.0000) | 5.34(0.0214) | 0.6(0.4394) |

|---|

| note2 | 1295.86(0.0000) | 5.38(0.0209) | 0.61(0.4357) |

|---|

| note3 | 1313.7(0.0000) | 5.42(0.0204) | |

|---|

| note4 | 1328.66(0.0000) | | |

|---|

-------------- D'AGOSTINO ----------------

K2=28.988918215165 (4.2164814679737)2 + (3.348164011126)2

(0)

d'Agostino: FAIL

------------------ ANDERSON-DARLING -----------------

A2=2.2203138506438

alpha=0

p-value=p < 0.01

A2=2.220314

(p < 0.01)

Anderson-Darling: FAIL

2009 OUT (4) : La Clarté de Haut-Brion;Pessac-Léognan;89;83.28;1.4897204917169

Global results

| Dependant variable | prix € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 368 |

| R2 | 0.79364124601775 |

| Adjusted R2 | 0.79251051311921 |

| Sigma error | 0.41348184325768 |

| F-Test(2,365) | 701.88215718096(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 239.9977 |

dfR = 2 |

MSR = 119.9989 |

MSR/MSE = 701.88 |

p < .0000* |

| Error |

SSE = 62.4030 |

dfE = 365 |

MSE = 0.1710 |

|

|

| Total |

SSTO = 302.4007 |

dfTO = 367 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=5.398342 |

s{b0}=4.229921 |

t0=1.276228 |

p = 0.2027 |

| note4 |

b1=0.000000 |

s{b1}=0.000000 |

t1=2.878769 |

p = 0.0042* |

| note3 |

b2=-0.000048 |

s{b2}=0.000021 |

t2=-2.240190 |

p = 0.0257* |

* indicates significance

Stepwise selection process for prix €

| Step | 1 | 2 | 3 |

|---|

| R2 | 0.7908 | 0.7936 | |

|---|

| note | 1328.54(0.0000) | 4.93(0.0270) | 0.65(0.4203) |

|---|

| note2 | 1349.79(0.0000) | 4.98(0.0263) | 0.66(0.4162) |

|---|

| note3 | 1368.23(0.0000) | 5.02(0.0257) | |

|---|

| note4 | 1383.56(0.0000) | | |

|---|

-------------- D'AGOSTINO ----------------

K2=22.793935134062 (3.6661661043644)2 + (3.0582938428595)2

(0)

d'Agostino: FAIL

------------------ ANDERSON-DARLING -----------------

A2=1.862773184555

alpha=0

p-value=p < 0.01

A2=1.862773

(p < 0.01)

Anderson-Darling: FAIL

2009 OUT (5) : Le Petit Cheval;Saint-Emilion;91;147.29;1.4865535902963

E_warning:(Division by zero

D:\web\blg\lib\MultipleRegression.inc.php @ L184

Global results

| Dependant variable | prix € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 367 |

| R2 | 0.7997010221038 |

| Adjusted R2 | 0.79860047826921 |

| Sigma error | 0.40662259178939 |

| F-Test(2,364) | 726.64168110893(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 240.2887 |

dfR = 2 |

MSR = 120.1443 |

MSR/MSE = 726.64 |

p < .0000* |

| Error |

SSE = 60.1845 |

dfE = 364 |

MSE = 0.1653 |

|

|

| Total |

SSTO = 300.4731 |

dfTO = 366 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=5.919472 |

s{b0}=4.162183 |

t0=1.422204 |

p = 0.1558 |

| note4 |

b1=0.000001 |

s{b1}=0.000000 |

t1=3.052927 |

p = 0.0024* |

| note3 |

b2=-0.000051 |

s{b2}=0.000021 |

t2=-2.403719 |

p = 0.0167* |

* indicates significance

Stepwise selection process for prix €

| Step | 1 | 2 | 3 |

|---|

| R2 | 0.7965 | 0.7997 | |

|---|

| note | 1368.28(0.0000) | 5.7(0.0175) | 0.47(0.4938) |

|---|

| note2 | 1391.48(0.0000) | 5.74(0.0171) | 0.48(0.4894) |

|---|

| note3 | 1411.78(0.0000) | 5.78(0.0167) | |

|---|

| note4 | 1428.8(0.0000) | | |

|---|

-------------- D'AGOSTINO ----------------

K2=17.002062557501 (3.1275883006327)2 + (2.6870530287373)2

(0.0002)

d'Agostino: FAIL

------------------ ANDERSON-DARLING -----------------

A2=1.5710231957273

alpha=0

p-value=p < 0.01

A2=1.571023

(p < 0.01)

Anderson-Darling: FAIL

2009 OUT (6) : Carruades de Lafite;Pauillac;91;122.98;1.3120484084862

Global results

| Dependant variable | prix € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 366 |

| R2 | 0.80449791855502 |

| Adjusted R2 | 0.80342077210077 |

| Sigma error | 0.4012932282473 |

| F-Test(2,363) | 746.87886255997(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 240.5491 |

dfR = 2 |

MSR = 120.2746 |

MSR/MSE = 746.88 |

p < .0000* |

| Error |

SSE = 58.4562 |

dfE = 363 |

MSE = 0.1610 |

|

|

| Total |

SSTO = 299.0053 |

dfTO = 365 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=6.381252 |

s{b0}=4.110049 |

t0=1.552598 |

p = 0.1214 |

| note4 |

b1=0.000001 |

s{b1}=0.000000 |

t1=3.205880 |

p = 0.0015* |

| note3 |

b2=-0.000053 |

s{b2}=0.000021 |

t2=-2.548226 |

p = 0.0112* |

* indicates significance

Stepwise selection process for prix €

| Step | 1 | 2 | 3 |

|---|

| R2 | 0.801 | 0.8045 | |

|---|

| note | 1399.75(0.0000) | 6.42(0.0117) | 0.33(0.5674) |

|---|

| note2 | 1424.67(0.0000) | 6.46(0.0115) | 0.34(0.5627) |

|---|

| note3 | 1446.61(0.0000) | 6.49(0.0112) | |

|---|

| note4 | 1465.15(0.0000) | | |

|---|

-------------- D'AGOSTINO ----------------

K2=13.921288887126 (2.7619113565375)2 + (2.5086120755819)2

(0.0009)

d'Agostino: FAIL

------------------ ANDERSON-DARLING -----------------

A2=1.3506100249623

alpha=0

p-value=p < 0.01

A2=1.35061

(p < 0.01)

Anderson-Darling: FAIL

2009 OUT (7) : Le Petit Mouton de Mouton-Rothschild;Pauillac;90;86.18;1.2617003209753

Global results

| Dependant variable | prix € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 365 |

| R2 | 0.80937001147724 |

| Adjusted R2 | 0.80831680712076 |

| Sigma error | 0.39631864978493 |

| F-Test(2,362) | 768.48334940697(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 241.4090 |

dfR = 2 |

MSR = 120.7045 |

MSR/MSE = 768.48 |

p < .0000* |

| Error |

SSE = 56.8588 |

dfE = 362 |

MSE = 0.1571 |

|

|

| Total |

SSTO = 298.2678 |

dfTO = 364 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=6.446095 |

s{b0}=4.059150 |

t0=1.588041 |

p = 0.1132 |

| note4 |

b1=0.000001 |

s{b1}=0.000000 |

t1=3.268263 |

p = 0.0012* |

| note3 |

b2=-0.000053 |

s{b2}=0.000021 |

t2=-2.600981 |

p = 0.0097* |

* indicates significance

Stepwise selection process for prix €

| Step | 1 | 2 | 3 |

|---|

| R2 | 0.8058 | 0.8094 | |

|---|

| note | 1437.07(0.0000) | 6.71(0.0100) | 0.22(0.6411) |

|---|

| note2 | 1463.42(0.0000) | 6.74(0.0098) | 0.22(0.6356) |

|---|

| note3 | 1486.64(0.0000) | 6.77(0.0097) | |

|---|

| note4 | 1506.28(0.0000) | | |

|---|

-------------- D'AGOSTINO ----------------

K2=11.149068253374 (2.3729693449714)2 + (2.3490603953921)2

(0.0038)

d'Agostino: FAIL

------------------ ANDERSON-DARLING -----------------

A2=1.1461139474184

alpha=0

p-value=p < 0.01

A2=1.146114

(p < 0.01)

Anderson-Darling: FAIL

2009 OUT (8) : Le Plus de la Fleur de Boüard;Lalande de Pomerol;91;115.04;1.2544045711893

Global results

| Dependant variable | prix € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 364 |

| R2 | 0.81384068281689 |

| Adjusted R2 | 0.81280932925909 |

| Sigma error | 0.39131489148289 |

| F-Test(2,361) | 789.09960280932(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 241.6655 |

dfR = 2 |

MSR = 120.8327 |

MSR/MSE = 789.10 |

p < .0000* |

| Error |

SSE = 55.2790 |

dfE = 361 |

MSE = 0.1531 |

|

|

| Total |

SSTO = 296.9444 |

dfTO = 363 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=6.889550 |

s{b0}=4.010278 |

t0=1.717973 |

p = 0.0867 |

| note4 |

b1=0.000001 |

s{b1}=0.000000 |

t1=3.420525 |

p = 0.0007* |

| note3 |

b2=-0.000056 |

s{b2}=0.000020 |

t2=-2.744902 |

p = 0.0064* |

* indicates significance

Stepwise selection process for prix €

| Step | 1 | 2 | 3 |

|---|

| R2 | 0.81 | 0.8138 | |

|---|

| note | 1468.36(0.0000) | 7.49(0.0065) | 0.12(0.7249) |

|---|

| note2 | 1496.55(0.0000) | 7.51(0.0064) | 0.13(0.7191) |

|---|

| note3 | 1521.53(0.0000) | 7.53(0.0064) | |

|---|

| note4 | 1542.82(0.0000) | | |

|---|

-------------- D'AGOSTINO ----------------

K2=8.6199657031266 (1.9904772695064)2 + (2.1582321336467)2

(0.0134)

d'Agostino: FAIL

------------------ ANDERSON-DARLING -----------------

A2=0.96752801970297

alpha=0.01

p-value=0.01 =< p < 0.025

A2=0.967528

(0.01 =< p < 0.025)

Anderson-Darling: FAIL

2009 OUT (9) : La Chapelle de La Mission Haut-Brion;Pessac-Léognan;90;82.26;1.2233787277499

Global results

| Dependant variable | prix € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 363 |

| R2 | 0.8184896540131 |

| Adjusted R2 | 0.81748126320207 |

| Sigma error | 0.38649825691648 |

| F-Test(2,360) | 811.67900882628(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 242.4987 |

dfR = 2 |

MSR = 121.2493 |

MSR/MSE = 811.68 |

p < .0000* |

| Error |

SSE = 53.7771 |

dfE = 360 |

MSE = 0.1494 |

|

|

| Total |

SSTO = 296.2758 |

dfTO = 362 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=6.953980 |

s{b0}=3.960969 |

t0=1.755626 |

p = 0.0800 |

| note4 |

b1=0.000001 |

s{b1}=0.000000 |

t1=3.485566 |

p = 0.0006* |

| note3 |

b2=-0.000056 |

s{b2}=0.000020 |

t2=-2.800155 |

p = 0.0054* |

* indicates significance

Stepwise selection process for prix €

| Step | 1 | 2 | 3 |

|---|

| R2 | 0.8145 | 0.8185 | |

|---|

| note | 1506.76(0.0000) | 7.8(0.0055) | 0.06(0.8080) |

|---|

| note2 | 1536.53(0.0000) | 7.82(0.0054) | 0.06(0.8014) |

|---|

| note3 | 1562.94(0.0000) | 7.84(0.0054) | |

|---|

| note4 | 1585.47(0.0000) | | |

|---|

-------------- D'AGOSTINO ----------------

K2=6.2822578440247 (1.5611042473682)2 + (1.9609210521777)2

(0.0432)

d'Agostino: PASS

------------------ ANDERSON-DARLING -----------------

A2=0.80797981750226

alpha=0.025

p-value=0.025 =< p < 0.05

A2=0.80798

(0.025 =< p < 0.05)

Anderson-Darling: FAIL

2009 OUT (10) : La Mission Haut-Brion;Pessac-Léognan;96;735.09;1.2160631192919

Global results

| Dependant variable | prix € |

| Independant variable(s) | note note2 note3 note4 |

| Examples | 362 |

| R2 | 0.81798936927512 |

| Adjusted R2 | 0.81697538247443 |

| Sigma error | 0.38158495947469 |

| F-Test(2,359) | 806.7061313953(p < .0000*) |

Table 1. ANOVA source table

| Source of variation |

SS |

df |

MS |

F Obs |

F Stat |

| Regression |

SSR = 234.9243 |

dfR = 2 |

MSR = 117.4621 |

MSR/MSE = 806.71 |

p < .0000* |

| Error |

SSE = 52.2729 |

dfE = 359 |

MSE = 0.1456 |

|

|

| Total |

SSTO = 287.1972 |

dfTO = 361 |

|

|

|

* indicates significance

Table 2. Test of regression parameters

| Parameter |

Estimate |

SE |

T Obs |

T Stat |

| Intercept |

b0=6.548419 |

s{b0}=3.912651 |

t0=1.673653 |

p = 0.0951 |

| note4 |

b1=0.000001 |

s{b1}=0.000000 |

t1=3.400871 |

p = 0.0007* |

| note3 |

b2=-0.000054 |

s{b2}=0.000020 |

t2=-2.713596 |

p = 0.0070* |

* indicates significance

Stepwise selection process for prix €

| Step | 1 | 2 | 3 |

|---|

| R2 | 0.8143 | 0.818 | |

|---|

| note | 1501.07(0.0000) | 7.3(0.0072) | 0.26(0.6128) |

|---|

| note2 | 1530.31(0.0000) | 7.33(0.0071) | 0.27(0.6046) |

|---|

| note3 | 1556.17(0.0000) | 7.36(0.0070) | |

|---|

| note4 | 1578.15(0.0000) | | |

|---|

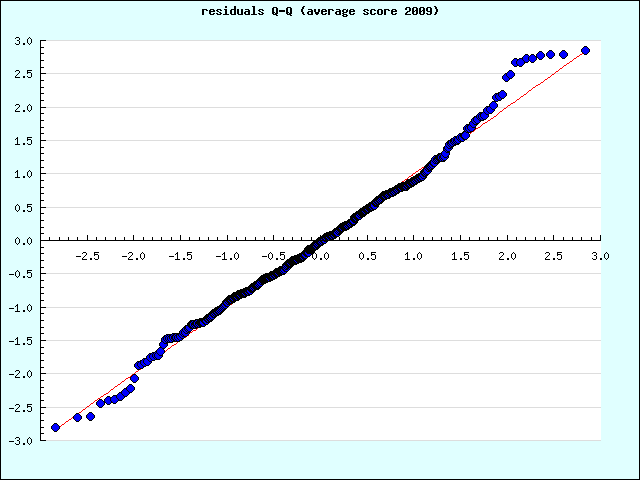

-------------- D'AGOSTINO ----------------

K2=4.3107466231743 (1.234064649088)2 + (1.6696799289222)2

(0.1159)

d'Agostino: PASS

------------------ ANDERSON-DARLING -----------------

A2=0.67684084255444

alpha=0.05

p-value=0.05 =< p < 0.10

A2=0.676841

(0.05 =< p < 0.10)

Anderson-Darling: PASS

-------------- D'AGOSTINO ----------------

K2=4.3107466231743 (1.234064649088)2 + (1.6696799289222)2

(0.1159)

d'Agostino: PASS

------------------ ANDERSON-DARLING -----------------

A2=0.67684084255444

alpha=0.05

p-value=0.05 =< p < 0.10

A2=0.676841

(0.05 =< p < 0.10)

Anderson-Darling: PASS

Price estimation (average) 2009 formula:

log(prix) = 6.548419349594 - 5.3772066965774E-5 * note3 + 5.4616961693912E-7 * note4